How long to keep tax records: a complete guide, individuals and business.

October 24, 2025 | by IoT Development Company

It is not only good financial practice to maintain your tax records, but you also need them so that you can comply, keep an audit trail and be able to rest. But How Long to Keep Tax Records? As an individual taxpayer, a freelancer or a business owner, you can save time and resources because you do not need to be confused with the legal obligations or clutters by knowing the rules of record retention.

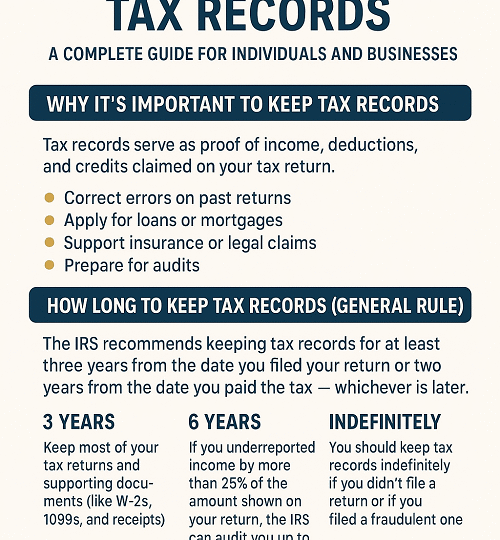

The Importance of keeping tax records.

Tax records will be used as evidence of the income, deductions, credits and the taxes you claimed on your tax return. The tax authority (or more precisely the IRS) may need to gain access to documentation to prove your tax returns. You might have to deal with delays, fines or fines without proper records. Also, it is always good to keep your tax documents because they can help you:

- Proper corrections of previous returns.

- Apply for loans or mortgages

- Legal claims and support insurance.

- Prepare for audits

Next, we can discuss the question of the duration of retention of tax records depending on various circumstances.

How Long to Keep Tax Records (General Rule).

The IRS suggests maintaining the tax records within a period of three years since the filing date of your tax return or two years since payment of the tax- whichever comes later. The reason is that the IRS usually has three years to audit your tax returns.

Sometimes, however, you will have to retain records over a longer period of time. Here’s a breakdown:

1. Three Years

Retain the majority of your tax returns and other supporting records (including W-2s, 1099s and receipts) at least 3 years. This is provided you made your returns properly and disclosed all the incomes.

2. Six Years

In case you failed to report the income that was over 25 percent of what was represented in your return, the IRS has the power to audit you within six years. Hence, retain your tax records at least half a decade in this instance.

3. Seven Years

Maintain such records seven years in the case of a loss on worthless securities or bad debt claim.

4. Indefinitely

Tax records should be retained forever in case you did not file a return or you had done a misleading return. The IRS does not have to evaluate further tax within the stipulated time.

5. Employment Tax Records

The businesses ought to retain the employment tax records at least 4 years since the tax is due or paid- whichever comes later. These consist of payrolls, employee details and other supporting documents.

Advice on keeping Tax Records secure.

Paperless Office: Scan and store the copy of your documents securely on your encrypted drive or on the cloud.

Label files properly: (income, expenses, deductions, etc.) by tax year.

Store securely: Hardcopies need to be locked away in a safe or a locked filing cabinet which is fireproof.

Get rid of them properly: Cut up old tax returns to avoid identity theft.

Final Thoughts

It is good to be aware of the time to retain tax records so that you remain in compliance, and to safeguard you in case of audit. Generally, the records should be retained during a period of three to seven years, depending on the case. In all cases of doubt, the safest thing to do is prolong them but with a certified tax expert, it is best to seek some personalized advice.

RELATED POSTS

View all